property tax forgiveness pa

It would grant up to 16000 in college loan forgiveness to students. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Pennsylvania Legal Aid Network

Up to 25 cash back All states have laws that allow the local government to sell a home through a tax sale process to collect delinquent taxes.

.jpg)

. Accordingly failing to pay your real property taxes in Pennsylvania could lead to an upset tax sale or a judicial tax sale and the loss of your property. Senior households from other parts of Pennsylvania can get an increase in their property tax rebate by 50 if. These standards vary from state to state.

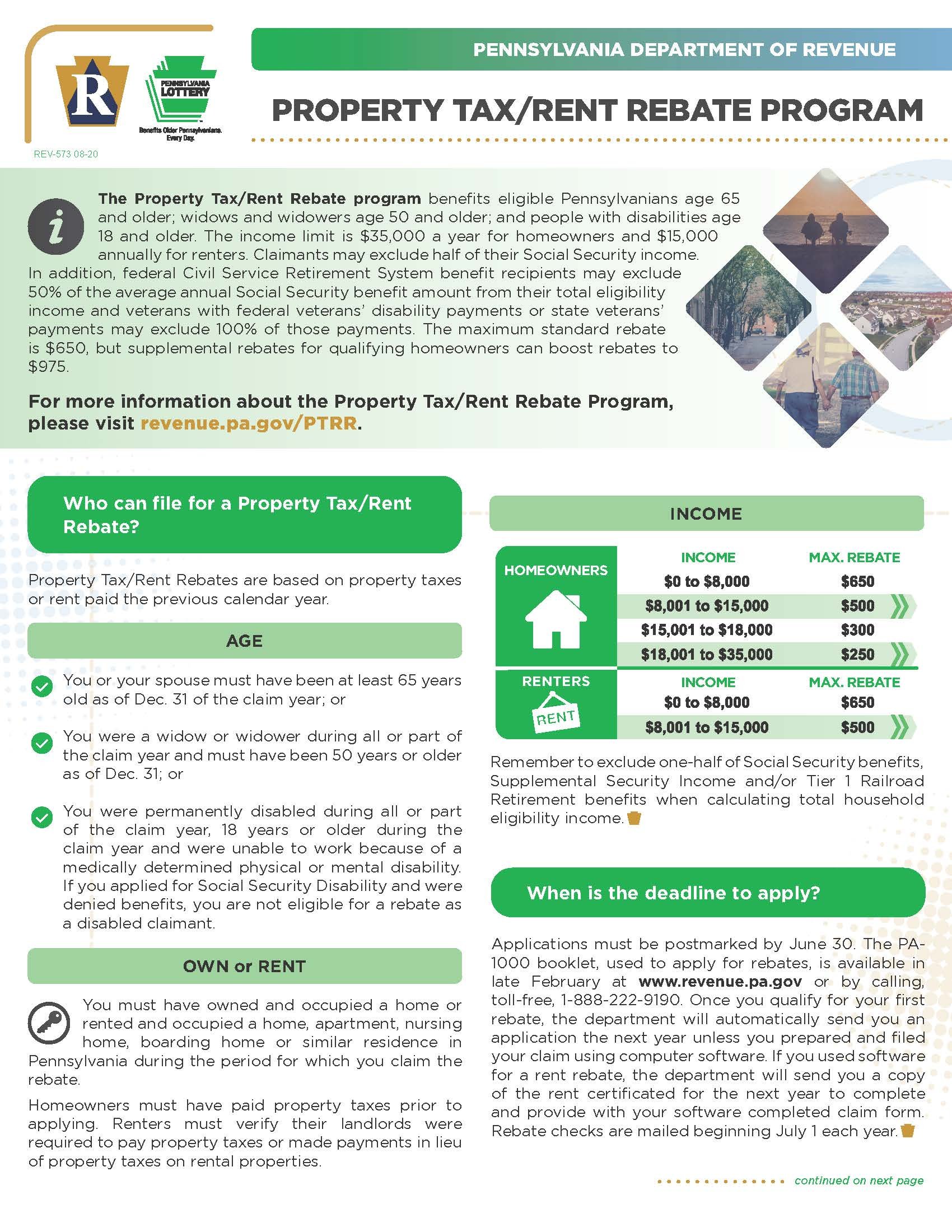

The Property TaxRent Rebate Program is one of five programs supported by the Pennsylvania Lottery. This is a state program funded by appropriations authorized by the General Assembly. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006.

Gifts awards and prizes- Include the total amount of nontaxable. Tax collecting officials including county trustees receive applications from taxpayers who. 135 of home value.

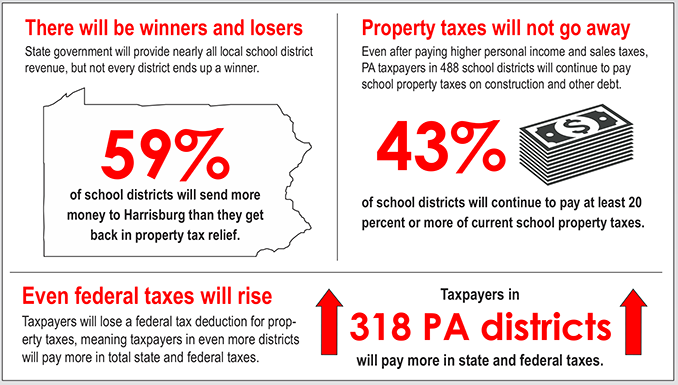

WTAJ Older Pennsylvanians and Pennsylvanians that have disabilities are now eligible to apply for rebates on their property taxes or. Boost the personal income tax from 307 to 472 and cap the homestead rebate at 5000 effectively eliminating school property taxes for more than 31 million homeowners. Below is a summary of how Pennsylvania tax sales work but tax.

House passes bills to address firefighter shortage by offering property tax credits college loan forgiveness and more. Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners as well as disabled veteran homeowners or their surviving spouses. Tom Wolfs 2021-22 budget proposal includes the largest personal income tax rate increase in state history while also providing some tax forgiveness or relief to lower-income Pennsylvanians.

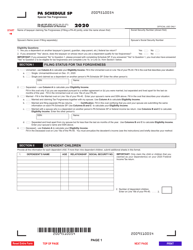

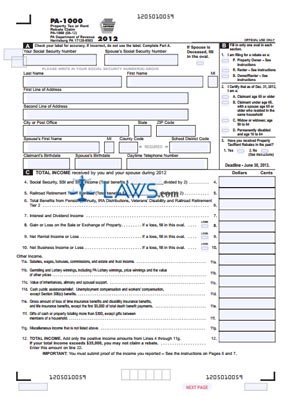

This can be done in the form of tax credits or exemptions. At the bottom of each column is an amount expressed as a decimal which represents the percentage of tax forgiveness you are allowed. A dependent is defined to be a child who can be claimed as a dependent for federal income tax purposes.

For example 10 means you are entitled to 100 percent tax forgiveness and 20 means you are entitled to 20 percent tax forgiveness. Since the programs 1971 inception older and disabled adults have received more than 71 billion in property tax and rent relief. Forgives some taxpayers of their liabilities even if they have not.

Hubert Minnis Prime Minister Minister of Finance announced the Governments immediate implementation of the Real Property Tax Forgiveness Program the Program as outlined in The Real Property Tax Amnesty Order 2021 the Order and which came into effect on 1. Taxes paid in December will now be assessed the penalty amount and those taxes must be paid by December 31 2020. Property tax reduction will be through a homestead or farmstead exclusion.

Their incomes are under 30000. Jan 25 2021 0110 PM EST. The level of tax forgiveness is based on the income of the taxpayer and the number of dependents the taxpayer is able to claim.

States also offer tax forgiveness based on personal income standards. Features myPATH offers for Property TaxRent. This is the first time in the history of the program that an electronic filing option is available for the Pennsylvanians who benefit from this program.

Effect an 85 billion elimination in homestead school property taxes by raising the personal income tax from 307 to 482 and the sales tax from 6 to 7. They pay more than 15 of income in property taxes. Philadelphia Scranton or Pittsburgh senior households with incomes of less than 30000 can get an increase in their property tax rebate by 50.

Provides a reduction in tax liability and. T 1 513 345 4540. The penalty for real estate taxes was forgiven through November 30 2020.

Posted on December 8 2020. Tax relief can be a big help because it can reduce or even completely negate the taxes you owe. Counties in Pennsylvania collect an average of 135 of a propertys assesed fair market value as property tax per year.

Pennsylvania is ranked number sixteen out of the fifty. Property TaxRent Rebate Program claimants now have the option to submit program applications online with the Department of Revenues myPATH system. Insurance proceeds and inheritances- Include the total proceeds received from life or other insurance policies also include inherited cash or the value of property received.

The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by the Commonwealth to each school district. Then move across the line to find your eligibility income. On 1 March 2021 during the Fiscal Strategy Debate the Most Honourable Dr.

The rebate program also receives funding from slots gaming. Property Tax Penalty Forgiveness. The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000.

To learn more about the PA. For example in Pennsylvania a single person who makes less than 6500 per year may qualify to have 100 percent of their state back taxes forgiven. It is designed to help individuals with a low income who didnt withhold taxes throughout the year and those who are retired.

T 1 312 302 8617. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP. To receive tax forgiveness a taxpayer must complete the tax forgiveness schedule and file a PA-40 return.

The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. Tax amount varies by county. 2 Following the bills enactment the Pennsylvania Department of Revenue.

5 2021 Pennsylvania enacted Act 1 of 2021 Act 1 specifically excluding forgiven Paycheck Protection Program PPP loans and economic impact payments 1 from personal income tax PIT.

School District Taxes West Mifflin Area High School

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

.jpg)

Pa State Rep Property Taxes Time To Eliminate

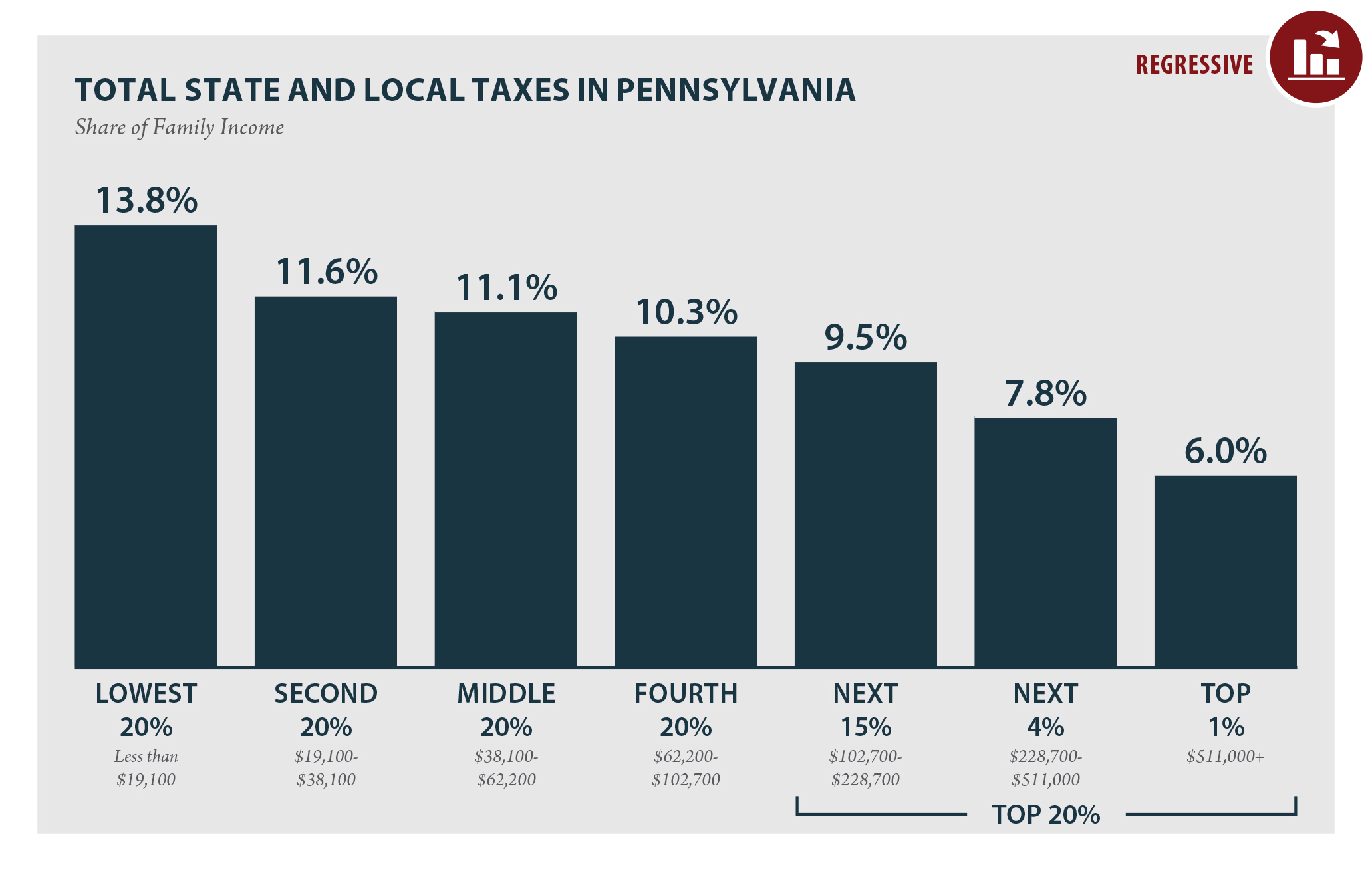

Property Tax Homestead Exemptions Itep

Pennsylvania Who Pays 6th Edition Itep

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

Taxing Retirement Income Part Of New Pa School Property Tax Relief Plan

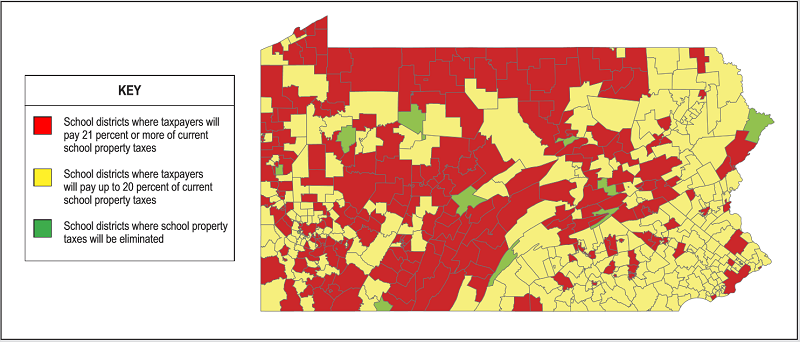

Unintended Consequences Property Tax Elimination Increases Taxes On The Middle Class To Reduce Taxes For High Income Families

Property Tax Bill Will Cost Pa Taxpayers More

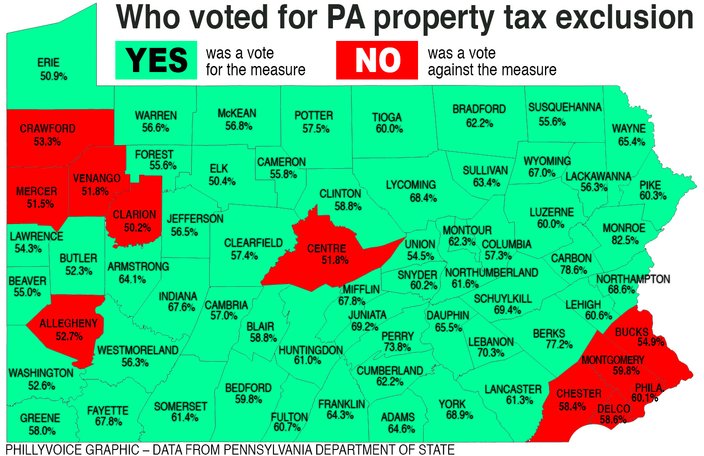

Map Here S Who Voted For Property Tax Exclusion In Pennsylvania Phillyvoice

Free Form Pa 1000 Property Tax Or Rent Rebate Claim Free Legal Forms Laws Com

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania